|

|

|

2010

December

30-31

|

Finishing up 2010

This year, the turn of the new year is more or less sneaking up on me — I'm doing a

consulting job, and the 31st and 1st are little more than consecutive days of work.

I'll close out the blog now, barring unforeseen developments. Happy old year!

Permanent link to this entry

|

2010

December

29

|

What not to name the baby

[Revised and extended.]

No, nobody near me is expecting a baby, but

I've come across several cases lately where people's names were

misfortunes. Let me share some advice about what not to name the baby.

(1) Don't give two people the same name. In this era of electronic

records and stupid credit bureaus, it is very important not to name a son

after this father. (Not even with "Jr." or "III" or what have you.)

If two people have similar names, their records will get mixed up.

Personally, I like the custom of naming people after their fathers, but the

financial industry currently can't handle it.

(2) Don't be too creative. Don't make up a new name by mixing syllables

together. Or if you do, make double sure that it doesn't mean anything

unsuitable in any language. I have recently met young women with the

misfortune to be named, respectively, Latrina (perfect Latin for "toilet")

and Demonica ("demonic" in several languages).

Don't even use a funny spelling or pronunciation. "My name is Patty but my parents decided

to spell it Ppattyie." That's a made-up example, but not very different from

some cases I've encountered in real life.

I've encountered a "Shron" which was supposedly "French for 'Sharon'" (it isn't!).

Make sure you know the normal

way to spell and pronounce the name.

The key idea here is that your name isn't just something you own — it is

a means of communication with other people. Don't make things hard on the other

people who need to recognize, spell, and pronounce your name. If there were no other

people in the world, you wouldn't need a name.

I should make it clear that I have no objection to creative names if they don't create

communication problems.

New names have to come from somewhere.

I heard of a dark-skinned young lady named Sepia, which I think

is a very elegant name, even if it's a word that hasn't been used as a name before.

(Look it up; it doesn't mean anything derogatory.)

The name Pamela was at one time totally made up by a writer; it has no etymology,

but it's a fine name (though I don't know what a certain actress is presently

doing to its popularity; it could go either way).

It's common for names of landmarks, flowers, etc., to become personal names.

There's nothing wrong with that.

(3) Consider the nicknames. If you want to name your son Agamemnon,

give him a common middle name such as Jack. Then he can call himself

Agamemnon if he becomes a Trojan War buff, or Aggie if he goes to

Texas A&M, or Jack if he does neither of those things.

Permanent link to this entry

|

2010

December

28

|

The end of several eras

Lots of things are coming to a sudden close this month.

Two of our favorite snacking places have gone out of business,

Five Points Deli (both locations)

and McAlister's Deli (a national chain, but we particularly

remember that the decor of the local one included a poster for a Turner

art exhibit that Melody and I saw shortly before our wedding in 1982).

On a worldwide level,

processing of Kodachrome film

is about to stop.

One lab was doing it for the entire world.

The Kodachrome process is extremely complicated and not suitable for small labs or

independent reverse-engineering.

Before you say, "Kodachrome was the best color film the world has ever had," ask yourself

whether this is really true, from your own experience.

I think the Ektachrome series has been better for at least 20 years, and maybe longer;

I switched to Ektachrome in 1982 and never turned back.

Locally, about 400 pounds of printed matter have left my home office as a first

attempt to straighten the place up. Many electronics magazines went to a deserving recipient.

Old semiconductor data books and the like went to the recycling plant. Now that we have the Web,

a lot of this printed literature will never be needed, and I need the space.

Permanent link to this entry

|

2010

December

27

(Extra)

|

Six minutes with a shortwave radio in 1971 or 1972

Here's something I just found in my audio archives: a tape recording of some shortwave

radio broadcasts, probably in late 1971, maybe some time in 1972.

You hear Radio Havana announce itself and sign off in English

("Free territory of America!"); then HCJB

treats a British listener to an instrumental performance of "Count Your Blessings" and a platitude;

then there's a short announcement in my voice, which was virtually the same

when I was fourteen as today; and finally you hear RSA, South Africa, sign on

with music and birdcalls.

Click here to listen.

Permanent link to this entry

|

2010

December

27

|

Wandering through old audio technology

When I was very young, one of my hobbies was tape recording. Fortunately, my parents

were very supportive, and I had decent (not top-end) equipment (for the time).

As a result, we now have recordings of some family gatherings and the like from the 1960s.

When I was very young, one of my hobbies was tape recording. Fortunately, my parents

were very supportive, and I had decent (not top-end) equipment (for the time).

As a result, we now have recordings of some family gatherings and the like from the 1960s.

And the other day I digitized one of them for my sister. This led to a minor technical

detective story.

I did the digitization by cabling my vintage 1980 (?) Teac four-track reel-to-reel tape deck

to my new, tiny, Tascam DR-08 digital recorder. Got the file into the computer, trimmed off

the silence at the beginning and end, listened, did a bit of filtering, burned a CD... and wasn't

satisfied.

Last night I realized what was bothering me. All the voices were a tiny bit too low-pitched.

My mother sounded a bit too much like my Aunt Dorothy. There were no other voices I could use

as an exact standard of comparison, but the whole thing sounded just a bit flat.

In retrospect, I'm surprised I was able to notice and quantify this.

So I sped up the sound, digitally, by 3% and got a much better recording. I threw away the

old CDs and burned new ones.

Next question: Where did the 3% error come from? That's half a musical semitone. Even for 1966,

I think it was a fairly big error. The NAB standard for tape speed accuracy is 0.2%.

My first thought was that something was wrong with the Teac. So I got out my calibration tape

(vintage 1969), played it into an HP frequency counter, and it read 11.785 kHz for what should

have been 12.000. That seemed to mean the Teac was about 2% slow.

But it was a perfectly consistent 11.785 kHz. Manipulating the tape flow in various ways

(helping the feed reel along, or even dragging on it a little) didn't have any effect. The error

was the same percentage at both speeds (3.75 and 7.5 ips) and in both directions.

What's more, the Teac doesn't have a fine speed control. Its motor is controlled by the frequency

of the AC power line.

I was starting to suspect some odd problem with the capacitors in the motor circuit, and then it

occurred to me: When measurements seem wrong, question the measurements.

I got out my Wollensak boat anchor (1500SS, vintage maybe 1970) and played the same calibration

tape into the same frequency counter. It read 11.600 with a lot of fluctuation. Wollensaks are

built like tanks, not like Swiss watches.

Then I got out a Herb Alpert tape from the very end of the 4-track era, looked up the track timings

on the Web, and played it on the Teac. Bingo — the timings were correct to within 1 second over

a 13-minute span. That's about 0.1% accuracy, or better. Nothing wrong with the Teac.

Also, the Wollensak was 1.5% slower than the Teac. That makes it quite plausible that an even

cheaper tape recorder in an even earlier year was indeed 3% faster than specified.

These were mono tape recorders, and prerecorded tapes were rarely used with them.

People recorded interviews and the like, and they only played back their own tapes.

(Aside: We don't realize how good we had it with cassettes. The big advantage of the cassette,

from the mechanical point of view, is that pulling the tape isn't much work,

so even a small motor has an easy job.

Even a small cassette deck can have a flywheel that

is much more massive than the cassette itself, ensuring well-regulated speed.)

Conclusion? Maybe my calibration tape has stretched a little in use, but more likely, when the

Robins company made it, their 12-kHz signal generator was a bit off frequency. It's fine for an

alignment tape but not for speed testing.

This led me to another question: How, apart from an alignment tape, can you tell that a tape head

is in alignment? Robins must have had a way, or they wouldn't have been able to make alignment tapes.

I figured out the answer. If you happen to be using a full-track recorder that records across the whole

width of the tape — as they did — you can calibrate it against itself. Record a high-pitched

tone, flip it over, play it back backwards,

and adjust the alignment to take it exactly halfway from its original position

to the position that produces the loudest playback. (No matter how the head was misaligned,

perfect alignment will be halfway between the original position and the position that matches the flipped tape.)

Repeat this a few times, until no change is needed, and you've got it.

Permanent link to this entry

|

2010

December

26

|

White Christmas, whiter December 26

Having spent all my Christmases in the South, I had never until yesterday

experienced a white Christmas. And today, the 26th, it's even whiter.

This is more snow than we get most years, and when we do get it, it doesn't come

until later in the winter.

Here's a time exposure of the backyard around 9 p.m. on the 25th, illuminated

by city lights reflected by the clouds:

And here's the backyard at 10 a.m. today (with 4 inches of snow, and more

still coming down).

Permanent link to this entry

|

2010

December

25

(Continued)

|

Miscellany

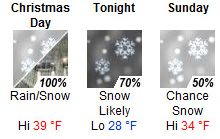

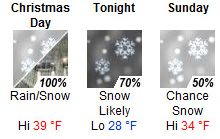

Non-trivial weather: Snow is uncommon here. Frozen slush is more common than snow.

I let the forecast (at right) speak for itself.

The stuff hasn't started falling yet.

Non-trivial weather: Snow is uncommon here. Frozen slush is more common than snow.

I let the forecast (at right) speak for itself.

The stuff hasn't started falling yet.

If you were brave enough to read my recent economics series — which is the work

of a rank amateur — please skim it again. There have been corrections and clarifications.

And I learned that it was read by total strangers.

Handy workshop hint: Before using Super Glue (Krazy Glue), test it to make sure it hasn't

gone bad (as it will do in a few weeks, or less, once it has been opened). We tested it by gluing some vinyl

electrical tape together, back to back (non-sticky side to non-sticky side). This is a material

that it glues only moderately well, so it's a good test.

Linguistics trivia for the day: The ending -ed on our past-tense verbs in English is apparently

a very ancient (1500-year-old) contraction of did. The old Germanic way of forming the past tense was

to change the vowel (as in run/ran).

Permanent link to this entry

Christmas 2010

This was our first partly-empty-nest Christmas; Cathy hasn't gotten back from Kentucky yet

(which is OK with us; it's a combination of academic schedules, weather, and other obligations).

We're not going to be the kind of parents who insist that all the offspring must turn up for

every Christmas Eve for the rest of our lives, regardless of what else they're doing.

Above you see our horizontal-format wide-aspect-ratio Christmas tree, actually a garland across

the mantelpiece. The "tree" proper is in a different room.

It's a conical hanging display of Melody's handmade Christmas

ornaments, with no greenery; under it is a table with presents on it.

Melody's and my major present to each other is a set of home improvements, starting with new

cabinet doors, actually finished a few weeks ago (see below). This is a temporary measure, to hold

us for a few years until we remodel. Traditionally, cabinet doors are made of pressed particle board

and look great at first — but when they suffer some wear and tear, there's no hope for them.

The great thing about painted wood, which is what we have now, is that when anything happens to

the surface, you can repaint it.

Other major presents are Sharon's Canon Digital Rebel XS camera and Cathy's new Asus desktop PC

(which she will arrive and collect in a few days). We decided not to have a lot of small presents,

but my girls surprised me with a Bosch lithium-ion cordless drill. (Have a holey Christmas?)

We're enjoying the semi-solitude and I'm doing a major clean up of my work area. The sad thing about

magazines is that they accumulate. I'm keeping everything old enough to be of genuine historical

interest (and in fact actively competing my collection of Popular Electronics from the tube era),

but I've given 15 years of QST to a worthy recipient and am thinking of giving 15 years of

Sky and Telescope to a school. Since about 1995 I simply haven't relied on magazines for

information the way I used to. I use them more like newspapers, to find out what is going on this month;

for archived information I go to the Web or to books. I've also disposed of about 40 pounds of

semiconductor data books from the 1990s, now completely superseded by the Web.

Then comes the "cleanup of a thousand tools" as I've been calling it. I'm gearing up for a big project.

More news when I have it.

Permanent link to this entry

|

2010

December

25

|

Feast Day of the Nativity of Our Lord

Permanent link to this entry

|

2010

December

24

|

Jupiter and the SEB revival

Uploaded early. Read tomorrow's news today!

Here are infrared and full-color views of Jupiter, December 22.

The infrared one was taken with my new DMK camera — this was actually the first

time I had used it on the sky, even though I've had it a month.

(There was a remarkable combination of bad weather and overwork.)

Both were taken with my 8-inch telescope under rather poor conditions. The infrared image is a stack of 2000

video frames, and the color one, a stack of 1500.

Look at the space where a major belt used to be missing. Now there are remarkable twists,

loops, and round spots. That is the South Equatorial Belt (SEB), and it will soon be as dark

as the North Equatorial Belt. (Following standard astronomical practice, I print these

pictures with south up, to match the view in a telescope.)

Permanent link to this entry

Someone who fought the English language and lost

This was in a spam e-mail I received; it gave a Los Angeles telephone number.

What is a "quench to stay on the brim of the abyss"? A quest, maybe, to stay on the

cutting edge of — what? I suspect thesaurus abuse. Do they know what an abyss is?

We wish you all a blessed Christmas!

Permanent link to this entry

|

2010

December

23

|

Finishing up the economic fairness series

I don't know if anyone is still reading it, but I need to finish up the series

that I'm writing in response to Mankiw's and Weinstein's papers about the gap

between the rich and the poor. This is going to be long, so hang on... or go

away, whichever you prefer.

More loose ends: Before I get to the main point, there are two more

loose ends to tie up. First, a correspondent points out that alongside the

education gap, there is a language gap. People who don't speak the national

language are less competitive on the job market. I'm all for helping first-generation

immigrants settle in, but (even though I'm a linguist) I'm not in favor of making

America a multilingual nation. The Canadian example shows us that bilingualism is

very costly. There are great benefits to having a single national language.

I wouldn't expect to go on speaking English all the time if I moved to France or Spain.

Anyhow, there is also a language gap for non-immigrants, between people who can

speak and write standard American English and those who can only produce a local dialect.

The Deep South and parts of the Northeast have strong local dialects; the West does not,

and westerners may not be familiar with the problem. The point is, plenty of people who

are not immigrants have to (and do) learn the national language in school.

Second, medical calamities are a quick path into poverty, and Obamacare doesn't fix

the single biggest problem with American health insurance, which is that it is tied

to employment. Lose your job and you're no longer insured. That situation arose as

a loophole in World War II wage controls, and it's high time to end it.

The gap between rich and poor:

Now, at least, we get to look at Mankiw's paper.

He cites data about how the gap between the rich and the poor has widened.

From World War II to the mid-1970s, income in all strata of society grew at about the same rate,

and throughout that period, the top 1% of the population got about 10% of the total income.

After that, the gap widened. Incomes in the top strata grew faster than inflation; those in the

lower strata did not. Today, the top 1% of the population gets 25% of the income, and it's still

rising. For graphs and more data, see Mankiw. [I am well aware that this kind of data can be questioned.

Measuring the income of the wealthy is clumsy and potentially inaccurate because so much of the income

comes through corporations and investments, not all the same kind and not all taxed the same way or

using the same accounting methods.]

Why did it widen? Mankiw mentions the education gap. By the late 1970s, everybody who wanted

to go to college was doing so. The increase had stopped. Also, although he doesn't mention it,

that's about when the productivity of unskilled workers stopped going up. Until then, they

had been benefiting from mechanization and from high-school education. By the 1970s, both of

those factors had gone about as far as they could. Nobody was doing without modern machinery

or a high-school education because they weren't available.

Liberals blame the Reagan and Bush tax policies for widening the gap, but in fact, the acceleration

began well before Reagan came into office.

(I am well aware that this is controversial. I am also well aware that it is easy to overestimate

how much money could be raised by soaking the rich. I am not advocating a tax policy here, just

defining the issues and questions.)

Before we jump to the conclusion that we should step up taxes on the rich, remember

that we never proved that making the rich poorer would make the poor richer. We might

be in any of 3 possible worlds:

(1) Maybe, if the rich were made poorer, the poor would automatically be richer.

This is what the left wing hopes, but what's missing is a mechanism to actually make it

work this way.

(2) Maybe, if the rich were made poorer, the poor wouldn't be affected.

(3) Maybe, if the rich were made poorer, the poor would also be worse off.

The idea here is that if the most productive people lose their incentive, they stop

doing things that benefit poorer people too. This has been called "trickle-down economics" —

when the rich get richer, the wealth trickles down, and when they don't, it doesn't.

Now my point is that we don't know which of these 3 worlds we're in unless we look at facts.

Wishful thinking or speculation won't do it. That's why economists have to do research, rather

than just sit around and think. One red herring is that simply taxing the rich,

to force the gap to become narrower, might not undo the process that widened it.

Utilitarian and deontological ethics:

Mankiw's paper mainly addresses a different question:

What should we want?

That is, how do we decide what is fair?

About a year ago I wrote about the difference between utilitarian and deontological systems of ethics.

Utilitarianism aims at "the greatest benefit for the greatest number."

Deontologism says that some things are right or wrong regardless of how many people they may or may not benefit.

In the 1970s, our society underwent a deep change in thinking that affected conservatives and liberals alike,

although it went largely unmentioned. It was beneath the surface.

Basically, we changed from utilitarian to deontological thinking. On a conscious level, we started

thinking more about individual rights and less about the collective.

Remember how schools (and armies) had lots of policies back in the Fifties of the form, "Everybody is

required to do this because most people want to do this?" It could be soldiers going to chapel, students

going to pep rallies, or whatever. That's the kind of collective thinking we jettisoned.

As I've mentioned before, one fruit of this change is that we decided that racial discrimination was wrong,

and we set out to get rid of it. To a true utilitarian, it should be OK to oppress a minority if doing so

benefits the majority. ("The greatest benefit for the greatest number.") The deontologist retorts that people

are people even when they're not the majority.

Nobody today, no matter how conservative, defends racial segregation on utilitarian grounds,

the way it was defended in the South just fifty years ago.

If anything, conservatives today are even more radically deontological on this issue than liberals:

they want to preserve individual freedom, not just shift the bias toward a different collective group.

Now to economics. Economists are good at calculating "the greatest benefit for the greatest number" and it's

easy for them to slip into actually adopting utilitarianism as a value system. That is what Mankiw objects to.

Although he does not follow the philosophical argument all the way to the end, his basic premise is that

people who choose to do things that society values have a right to profit from them,

even if that does not maximize the collective benefit to humanity as a whole.

As a crucial example, he points out that we do not choose to forcibly redistribute most of our income to poor people

outside our own country, even though doing so would alleviate a lot of suffering. In fact, most of us feel

that if we were doing that, it wouldn't be an economy — it would be a strange exercise in national

charity. We would no longer be letting people keep their own earnings.

In spite of that, Mankiw does not advocate a flat tax. He says there are still some reasons to tax the rich

progressively.

He mentions basically what I was saying the other day about externalities and public services.

I think he would also accept my point that the wealth of the rich is more easily sheltered from taxation,

and tax rates should compensate for this.

Weinstein on scalable professions:

Now to Weinstein's paper.

Weinstein's main point is that we should not be hasty in assuming that a free market

allocates resources fairly. It does if the interacting agents are very numerous and not

particularly powerful. But he points out that workers come out very differently if they function

as a unit (a union) or as individuals. Whichever outcome you think is the fair one, the other one

isn't, so you cannot say across-the-board that the free market enforces fairness. It is only one

of several mechanisms that can interact to produce fair outcomes.

A more intriguing example from Weinstein has to do with

Shapley value.

Assume a market that is not

all there at once; rather, individuals enter it one at a time. Take the same set of individuals and

make them enter it in all possible orders. Average their outcomes across all the different orders.

Then most workers and other small entities come out about the same as if the whole economy were present

at the beginning. But workers in scalable professions — entertainers depending on the size of

the audience, investors depending on the availability of capital — come out, on the average, only

half as well, because, on the average, they arrive with only half of the rest of the economy present.

From this, Weinstein suggests that a marginal tax rate of 50% on entertainers and the like would

be acceptable, in the sense that it wouldn't deprive them of the rightful fruits of their labor.

(I assume the tax would go up to 50% only after their income went well above that of the average worker,

so as not to destroy their incentive. Actually, Weinstein hasn't addressed the issue of incentive.)

So should our taxes be more progressive?

That is, should we tax the rich more heavily, in comparison to the poor,

than we are doing now?

I think so, in moderation. Not because the rich "deserve" to be impoverished;

they don't, and that's not the goal.

But tax money has to come from somewhere, and a progressive

tax system causes less hardship than a flat tax. We have prospered with a tax

system significantly more progressive than what we have now. And Weinstein argues

convincingly that, when applied to very high incomes from scalable professions such

as entertaining and investing, relatively large progressive taxes are not unfair.

But I think we should take some precautions:

(0) What we do while trying to get out of a severe recession is not the

same as what we do in the long run.

It would be silly to raise taxes merely to pay them back out as "stimulus money"

to the same people.

(1) The optimum tax system is still open to debate. We must be

alert to signs of diminishing incentive. The highest tax rates sanctioned by

Weinstein's calculations are considerably lower than the extreme left wing wants

(although higher than George W. Bush advocated).

(2) Income or wealth brackets should be inflation-indexed.

Inflation by itself should not move people into higher tax rates,

as it did in the 1970s.

U.S. income tax brackets have been inflation-indexed since 1985.

[I thank a correspondent for pointing this out.]

(3) Total taxes of all types should never exceed (or even approach) 100%,

because that is tantamount to commanding someone to stop working.

Notoriously, this happened to Swedish author

Astrid Lindgren,

who had to stop writing Pippi Longstocking books.

I would say that the government has no moral right to tax any legal activity (or property)

at such a rate as to eliminate it.

There. I'm through being an amateur economist for a while. At least one professional

economist has recommended this series — and I'm flattered. Professionals will notice

that I'm avoiding economic jargon and expressing technical concepts in ordinary language

as best I can. Now I'll go back to being an amateur astronomer!

Permanent link to this entry

|

2010

December

22

|

Time out for a lunar eclipse

I had the good fortune to wake up at 2:30 a.m. on Tuesday morning (Dec. 21) and go

outside. Seeing a clear sky, I quickly set up my Canon 40D with a 300-mm lens on a tripod

and took some snapshots of the moon. Here you see a stack of one each 1/4- and 1/2-second exposures

at ISO 400, shooting in live-view mode with a 2-second shutter delay to minimize vibration.

The eclipse coincided with the winter solstice (shortest day of the year), and some of the news

media had an odd story about how this was the "darkest night in 456 years." Surely not; any winter

solstice with the moon not visible (because it's near New rather than Full) produces a darker night.

There is one way in which the eclipse coinciding with the solstice is significant.

If you live in the north temperate latitudes and at the right longitude (which, for this eclipse,

was a broad patch spanning California), you get to see the eclipsed moon as high in the sky

as it ever gets.

No such luck for Georgia, but at least I got pictures. Apparently, almost all of the state was

clouded out, and even in Athens, the sky was only clear for about 20 minutes.

Of all the people I've heard from, only Chris Hetlage

at Deerlick had a better photo session than I did. (As of right now, that link does not yet

include his picture of this eclipse.)

The economics series will resume tomorrow if anybody is still interested in reading it.

Permanent link to this entry

Short notes

We are saddened to hear that Five Points Deli

has gone out of business.

Where will we get curry chicken salad?

I'm still very busy with programming work, both at UGA and as a private consultant, so it's going

to be a somewhat quiet Christmas. Sharon is home from college; Cathy probably won't get here until

after the 25th. Merry Christmas to you and yours!

Permanent link to this entry

|

2010

December

20-21

|

Rich versus poor: education and marriage gaps

Putting the cart before the horse, before I present data about the widening gap

between the rich and the poor, I want to mention two non-economic factors that

appear to be contributing to it.

One, which Mankiw mentions in his paper, is the education gap.

Education adds more to your earning power than ever before.

But not everybody gets a good education.

I have no quick fixes to offer, except to note that in 1960 our whole country

was strongly motivated to educate a new generation of children, and today we're not.

What's worse, as anyone who has worked with an inner-city school knows,

far too many lower-class parents don't want their children educated.

I've seen parents heckle, yes heckle, a literary show in a middle school right

here in Athens. Reportedly, what I saw was not a rare phenomenon.

The fix to this problem has to be cultural. You can't deliver education to people

who don't want it, but you can certainly encourage people to want it.

President Obama is doing a lot of that — his ability to reach out to nonwhite,

non-elite ethnic groups is the best thing about his presidency.

Another thing we might do is increase the economic value of the brief education that

poor people do get. We've turned high schools into SAT preparation courses, such that

anybody who doesn't actually proceed to college comes away empty-handed. I advocate

going back to the notion that high school should prepare people for life.

Even college-bound people would benefit from courses in personal finance, basic civics,

and industrial arts! Take your college courses in college; use high school for things that

you can't do later.

Mankiw doesn't mention the marriage gap, on which see

this

article by former Georgia Chief Justice Leah Ward Sears

(or Google her name for more articles).

Basically, single parenthood is a quick path into poverty, and all too often,

it now starts with out-of-wedlock birth rather than with a failed marriage.

As the

so-called Sexual Revolution has filtered down to less and less sophisticated people,

it has done more and more damage.

Divorce and "sexual liberation" used to be luxuries for the well-to-do. Not any more.

College-educated people are now appreciably more likely to be faithfully married

than the less educated.

(And, I would add, when they break up, it does less damage; they don't abandon their children.)

I have not studied this problem in depth, but I know that as a compassionate society,

we're in a fix. We want to protect children from their parents' bad decisions,

so we need a relatively generous child welfare system — but if it's generous enough

to do its job, it's also generous enough to tempt some

women to make careers of being unwed mothers, and to make a lot of men think

they need not fulfill their responsibilities because the state will fill in for them.

We can't win.

I think that this, too, is a problem that needs to be addressed culturally.

Faithful marriage isn't an obsolete tradition or religious doctrine — it's common sense.

It's something everybody benefits from.

For sixty years we've had TV sitcoms poking fun at marriage and parenthood. In the 1950s, they were funny

because the audiences were so solidly in favor of marriage that they enjoyed laughing at its occasional

fumbles. But since 1970 or so, our popular culture, as doled out by Hollywood and Madison

Avenue, has had little to say in favor of either marriage or parenthood. It's more glamorous to be single,

unattached, footloose and fancy free. Those are the people with disposable income, and hence the people to whom

the advertisements are directed, and hence the people for whom the TV shows are made.

There is also social pressure not to speak out

against sexual shenanignans because you might offend your neighbors. There are too many people

doing conspicuously irresponsible things. This is a holdover from when "swinging" and divorce were

the hobby of the upper middle class.

We need to get the message out: Real men and real women stay faithful to each other and

to their children. You are not being "intolerant" or old-fashioned if you say so.

Not even if you "offend" some people who aren't living this way.

Perhaps the economic consequences will impress people even if morality doesn't.

Permanent link to this entry

|

2010

December

18-19

|

Rich versus poor, continued

[Minor updates.]

Before I get to Mankiw's and Weinstein's papers, a few more preliminaries.

We agree that the rich should pay more taxes than the poor.

The question is to what extent they should pay taxes at higher rates.

If your income doubles, should your taxes double, or should they go up

even more?

Ordinary people are often quite

confused on this point. If you think that when your income doubles, your

taxes should double, you're advocating a flat tax, with the same rate for everyone.

Almost everyone thinks that when your

income doubles, your taxes should more than double. Among the options that

are being considered, the flat tax is at the bottom of the scale. It's not what we

have now, and we'll probably never have it. All proposed tax systems have higher tax

rates for the rich than for the poor. The only question is how much higher.

Now then. Why should the rich pay taxes at a higher rate than the poor?

A lot of reasons can be offered, some of them better than others. Consider:

(1) Maybe the goal is just to collect money where it will cause the least hardship.

Tax money has to come from somewhere.

I respond: That is obvious, and it's a perfectly good reason to tax the rich

at a higher rate, but taxing the rich

more heavily might have an undesirable side effect,

such as reducing productive people's incentive to work.

Economists do research to try to find out the extent to which that is the case.

(2) Maybe you feel that

the rich need to be punished for whatever they did that made them rich.

I respond: Unless you can prove that they got rich by doing something destructive,

you're simply evincing

envy

and are not on the moral high ground here.

(3) Maybe the rich did do something that is costly to the rest of us, and

they ought to be paying to compensate us for the loss.

That's what economists call an externality.

The most familiar externalities are environmental pollution and consumption of natural

resources. The two are essentially the same thing, if you

think of the earth's ability to handle waste as a resource that can be used up.

(Suppose that person B isn't allowed to discharge waste at all because person A is already discharging

as much as the local environment can handle. Then B is suffering from A's externality.)

Or maybe, in getting rich, the rich have used more than their share of some other kind

of public resource without paying for it.

I would say that, in this case, you should find

the specific externality or public resource and tax it, rather than just taxing people for being rich.

But Mankiw and others argue that some public resources, such as use of government services,

are hard to quantify.

(4) Maybe the whole economy would benefit from transferring wealth from the rich to the poor.

That's how a lot of people feel, but is it a fact or just a feeling?

That's a question for the economists. It would be very naive to suppose that there is a fixed

amount of wealth, and if the rich didn't have it, the poor would have it. More likely, if the rich didn't

have it, it would never have been produced.

If all we need is to redistribute a fixed amount of wealth, then we could all stop working and let the

government confiscate all the dollars and hand them out again in equal quantities to

everyone. Then, with no work at all, we would have eliminated poverty. Right? Wrong, of course.

(5) Maybe the rich need a higher nominal tax rate because they are better at sheltering their

wealth from taxes, so that even if a flat tax is what you actually want, the official rate for the rich needs

to be higher in order to achieve that effect.

This should be studied. It is a good reason for paying

attention to loopholes and special cases in the income

tax laws. It is also an argument for replacing income taxes with sales taxes, on the ground that it is

harder to shelter spending than income.

(6) Maybe the very rich are especially dependent on the rest of the economy,

the way an entertainer (for instance) makes more money from the same performance if the

audience is larger.

If this is so, taxing them more heavily would not be unfair.

That is a key idea in Weinstein's response to Mankiw, which we'll look at presently.

Next time I'll address the issue of opportunity and behavior. Maybe, after that, we'll actually

get to Mankiw and Weinstein!

Permanent link to this entry

|

2010

December

16-17

|

Rich versus poor

I'll resume discussing Mankiw and Weinstein, and the widening gap between

the rich and the poor, soon. In the meantime, let me crystallize one question:

Would the poor be richer if the rich were poorer?

If not, there's no point (other than pure envy!) to want to narrow the gap.

The left-wing theory (worked out in detail by Karl Marx)

is that the rich are indeed stealing the poor people's wealth

— not personally, of course, but through an economy that systematically transfers

wealth from poor to rich — and we need to stop or counteract this.

An alternative explanation — dripping with right-wing naïveté, perhaps,

until I flesh it out — is that maybe there are better opportunities to get rich,

and a substantial number of people aren't taking them.

More about this tomorrow.

How we got out of the ice storm: Yesterday afternoon (Wednesday, Dec. 15) we drove to

Atlanta, intending to shop, have dinner with Sharon, and then bring her home.

Around 2 p.m. we heard on the radio that there was sleet and snow near the airport.

We called Sharon, told her that we were coming right away, picked her up, made one stop

at a store, watched the thickening snowfall, and fled northeastward, immediately getting out

of the snow and sleet. Atlanta had about 1,000 car wrecks that evening. We were home in Athens

before it got bad.

The store we stopped at was

Showcase Photo,

where I bought small quantities of darkroom chemicals, hoping that during "dead week"

(the week between Christmas and New Year's) I can actually get my darkroom in action

for the first time since November 2006.

Permanent link to this entry

|

2010

December

15

|

The exact problem with leveling

Today, just a tidbit. Mankiw, citing Mirrlees and Vickrey,

makes clear exactly what is wrong with leveling.

Leveling is the notion, popular at one time, that, in effect,

nobody should be allowed to be richer than anybody else.

In practice, you allow them to be somewhat richer, but you

put strict limits on it.

The idea is to make a world that is fairer to people who, due to

circumstances or lack of innate talent, aren't as productive as others.

The idea is that anybody who works hard should get about the same income,

even if circumstances prevent them from being as economically productive

as others.

And the problem is that you can't measure capability, defined as what you're

given by circumstances and innate talent.

You can only measure income, which depends on capability times effort.

So the exact problem with leveling income

is that it gives the most capable people

a strong incentive to reduce their effort. Capable people aren't allowed

to bring in a higher income,

but they can get the same income with less work. That is why the Soviet Union

went down the drain.

Tomorrow: The question of income redistribution is related to

utilitarian versus deontological ethics.

Mankiw starts to develop this argument but doesn't quite follow through; he says

he's not familiar enough with the relevant philosophy. Stay tuned...

Permanent link to this entry

|

2010

December

12-14

|

What is economic fairness?

In the next few days I hope to discuss, in more detail, the two

papers linked here.

The old political controversy was equality of opportunity vs. equality of outcome

(forcible socialistic leveling of people's income). Only the extreme Left now advocates that.

The new political controversy is equality of opportunity vs. the allocation produced by the

free market — on the argument that the free market doesn't do exactly what we want.

In particular, the Weinstein paper makes a mathematical argument that the free market does not

automatically allocate resources fairly, particularly for people in scalable professions.

A scalable profession is one in which the same amount of work can produce different amounts

of value, depending on some external resource. An entertainer can

produce more value by doing exactly the same work for a larger audience.

A stock trader can profit

more from doing the exact same work with more capital.

But doctors and carpenters aren't in scalable professions; the only way they can produce more

value is by doing more work, or doing it more efficiently or with higher quality.

More on this later. Scroll up to later dates to read the rest of this series.

Permanent link to this entry

|

2010

December

11

|

A principle to live by

An open message to Miley Cyrus, and everybody else:

If you don't want people to see you doing something, don't do it.

'Nuff said. Now if that were my daughter...

More to the point, I've always believed that living a double life is,

in the long run, impossible. If people were to spy on me, I'd regret the loss

of privacy, but they'd never find anything really damaging. Puzzling, maybe.

Boring, surely. But not damaging. This is what we call integrity.

Permanent link to this entry

|

2010

December

10

|

A good use for dollar coins

My new year's resolution, which I acted upon today, is to serve my country

by putting dollar coins in circulation. The dollar coin is an idea whose time

has come.

I use them in vending machines. Without any external indication or announcement,

most vending machines apparently started accepting dollar coins several years ago.

So I get dollar coins in rolls of 25 at the bank, stash them in my office, and

use them to get a soft drink to go with lunch. It beats trying to find a half dozen quarters or seeing

if the machines will chew up my dollar bills. All too often I don't even have

a $1 bill on hand.

The University has a card-based micropayment system, but — unlike students —

faculty members can no longer make deposits on line, so I've stopped using it.

Back to real money!

Permanent link to this entry

|

2010

December

8-9

|

Short notes

The radio interview was quick and, probably, disappointing.

By way of background, on November 26, an unexplained sonic boom was heard over northwest

Georgia, and the Atlanta Journal-Constitution quoted me as saying it could have been a meteor.

Sure enough, soon I got a quite credible report that the meteor was seen. Case closed.

The interviewer wanted to talk about unexplained sonic booms. Yes, I thought it was probably

a meteor. A meteor was seen in the right place and time.

What else could it be? A military aircraft. But the local airport says there weren't

any military aircraft. Well, they wouldn't necessarily know! Is a meteor the same as an asteroid?

No... And so it went.

Lastest hoopla in the Atlanta paper and also on CNN is a "fireball" that is obviously an

aircraft vapor trail lit by the setting sun at a low angle. It was videotaped by someone who,

of course, didn't hold the camera especially still, and if you don't realize this, it seems to

be darting around.

Recommended: JVC HA-S150 headphones.

I wanted something very lightweight that I could take on and off very quickly, and

which do not block outside sounds very well, so I could use them in settings where

I might be interrupted. I was thinking Sony MDR-V150

(which I've been very pleased with in the past), but these are even lighter

and sound every bit as good. $20 at the local Best Buy.

The only drawback? The plug is straight, not right-angled as I hoped it might be.

Permanent link to this entry

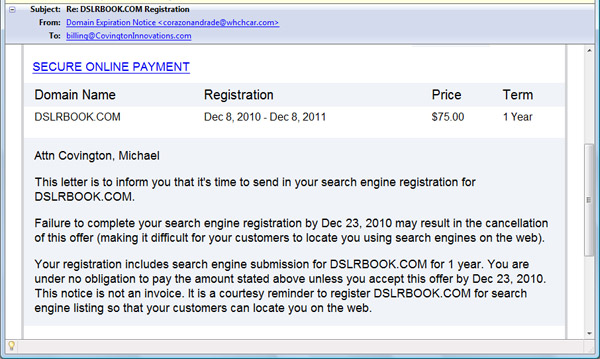

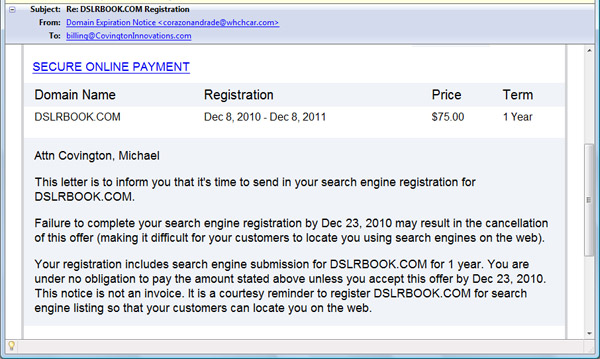

Scam of the day: Fake bill for search engine registration

Someone sent me this in the hope I would (1) mistake it for a domain registration bill,

and (2) pay it, by mistake or out of uncertainty.

First off, if it were domain registration, the price would be exorbitant. $75 for a year?

In real life, $7.50 is not bottom dollar...

Second, "search engine registration"? That means they are going to send Google, Bing, etc., a short

message suggesting that they index my site. That might be a good idea, but not $75 worth of work,

and it doesn't expire after a year.

Remember, Google wants to index my site, and every other site on the whole Web. I don't have

to prod Google. If my site were brand new, I might want to tell Google that it had suddenly

sprung into existence, but if there is a reference to my site on any site that Google has already found,

Google will find me.

This one doesn't, but other "search engine registration" entrepreneurs claim they can fool Google

into bringing "more traffic" and giving me a "higher ranking."

Well... Do I want Google to bring me people who aren't actually looking for what I have to offer?

No, I don't think so. I call this the "aardvark problem" and have written about it elsewhere.

As for ranking — that is, whether I'm the first one Google mentions in response to a search, or the

fifth, or the fiftieth — remember that Google is trying to be fair. And Google is very sensitive

to attempts to manipulate it. Start fooling around with strange, artificial links,

and you'll convince Google you're up to no good, and go down in the rankings, or get hidden

altogether.

Anyhow — your very first piece of correspondence was intended to deceive me. From now on am I going

to trust you for anything?

Permanent link to this entry

|

2010

December

6-7

|

Upcoming radio appearance

I'm going to be interviewed on a radio show

called Happenings Q&A

at 2:15 p.m. EST on Wednesday, December 8.

This is apparently a local show in Kenosha, Wisconsin, although there may be some

network distribution — I'm not sure about that.

If you care to, you can listen by going to www.wlip.com

and clicking "Listen Live."

What I don't know is the subject of the interview!

Permanent link to this entry

|

2010

December

4-5

|

Thought for the day

Great things are done by neglecting what is urgent

in order to do what is important.

Permanent link to this entry

|

2010

December

2-3

|

Short notes

What people use instead of a tape recorder these days:

a Tascam DR-08 is on its way

to me, thanks to a Christmas gift from Melody's parents.

(Hint: The street price is a lot lower than the list price.)

It's the size of a candy bar, records audio better than any tape recorder ever did,

and is also a dandy MP3 player.

Have you ever used continuous

grommet material?

It's a U-shaped strip of plastic that fits on any sharp edge in metal or other thin material.

Normally, you put it around a hole you have cut in metal when wires are going to

pass through it. I used some to fix up the bottom edge of an old cracker tin,

which is a keepsake but was starting to rust.

You can set up your own

charitable

investment fund for as little as $5000. Hmmm... When I'm old and rich...

Permanent link to this entry

|

2010

December

1

|

Going retro...

I'm too busy to write very much, so go and read

my December 2004 blog

— that was an interesting month.

Permanent link to this entry

|

|

|

This is a private web page,

not hosted or sponsored by the University of Georgia.

Copyright 2010 Michael A. Covington.

Caching by search engines is permitted.

To go to the latest entry every day, bookmark

http://www.covingtoninnovations.com/michael/blog/Default.asp

and if you get the previous month, tell your browser to refresh.

Entries are most often uploaded around 0000 UT on the date given, which is the previous

evening in the United States. When I'm busy, entries are generally shorter and are

uploaded as much as a whole day in advance.

Minor corrections are often uploaded the following day. If you see a minor error,

please look again a day later to see if it has been corrected.

In compliance with U.S. FTC guidelines,

I am glad to point out that unless explicitly

indicated, I do not receive payments, free merchandise, or other remuneration

for reviewing or mentioning products on this web site.

I have a Canon EOS 20Da camera and a Tektronix

TDS 210A oscilloscope on long-term loan from their manufacturers. Other reviewed

products are usually things I purchased for my own use, or occasionally items

lent to me briefly by manufacturers and described as such.

|

|

When I was very young, one of my hobbies was tape recording. Fortunately, my parents

were very supportive, and I had decent (not top-end) equipment (for the time).

As a result, we now have recordings of some family gatherings and the like from the 1960s.

When I was very young, one of my hobbies was tape recording. Fortunately, my parents

were very supportive, and I had decent (not top-end) equipment (for the time).

As a result, we now have recordings of some family gatherings and the like from the 1960s.

Non-trivial weather: Snow is uncommon here. Frozen slush is more common than snow.

I let the forecast (at right) speak for itself.

The stuff hasn't started falling yet.

Non-trivial weather: Snow is uncommon here. Frozen slush is more common than snow.

I let the forecast (at right) speak for itself.

The stuff hasn't started falling yet.